Investment management

Risk management: for solid foundations

We believe that investing involves much more than just a sequence of operations. It’s about competent specialists providing expert advice, and knowing someone you trust is looking after your assets. It’s also about teaming up with an experienced professional who will monitor your portfolio while you concentrate on the other parts of your life. When you invest, you’re building the future you’ve always dreamed of!

Knowing your goals is one thing, but understanding how to achieve them is quite another. Since most investors need advice on the best way to meet those goals, Verne Asset Management is here to support you every step of the way.

No matter what kind of account you have,

Verne Asset Management is here to help.

Private Wealth Management*

Investment accounts

TFSA

RRSP

RRIF

LIRA

LIF

Capital Class investment portfolios

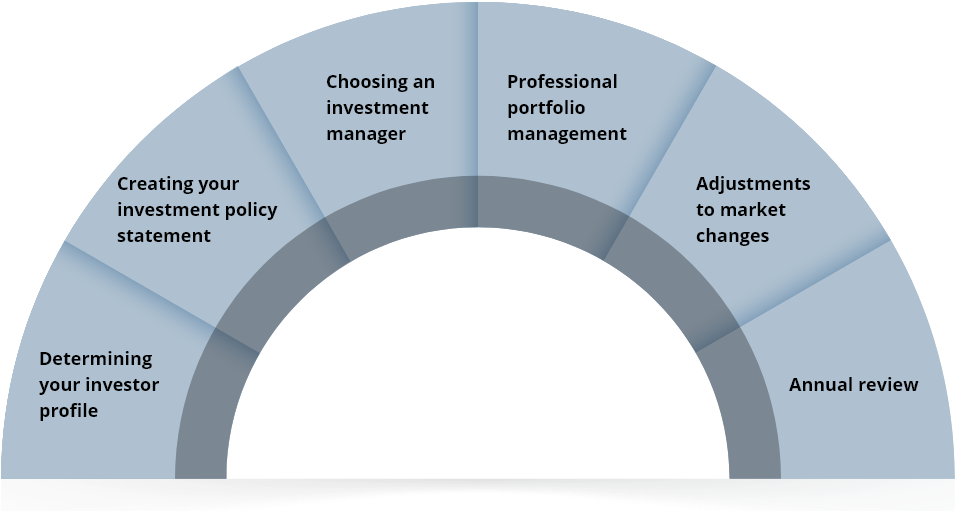

A unique, continuous

investment consultation process

Determining your investor profile

Your investor profile will help you determine what kind of investment is best for you. This is calculated using your level of risk tolerance, your goals, and the length of time you wish to invest.

Together, we can decide what your goals are and determine your investor profile. We will sit together to go over questions such as “What do you want to do with your money?” and “When do you want to do it?”.

Some investors are comfortable watching their investments fluctuate significantly. Others lose sleep over it. That's why an investment that works for one person is not necessarily right for someone else. You’ll need to start by determining how much risk you are willing to take.

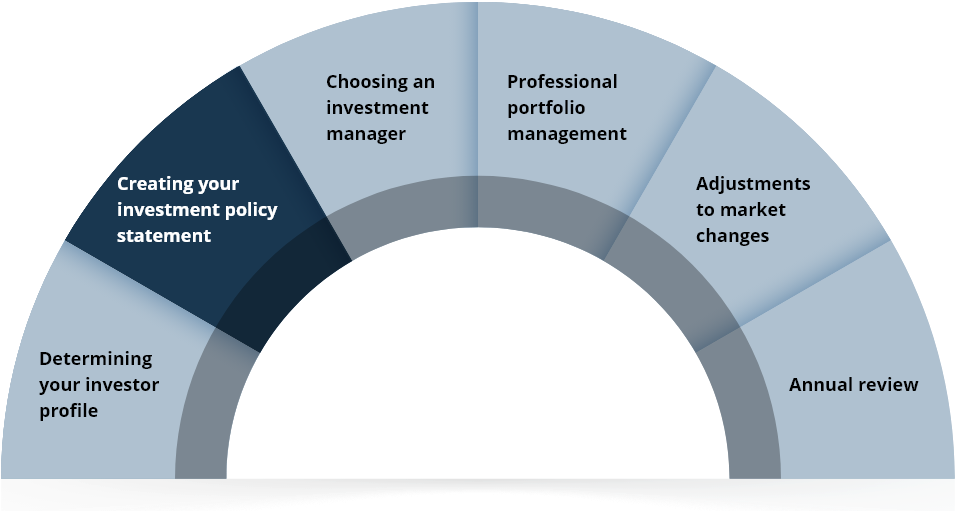

Creating your investment policy statement

An investment policy statement (IPS) outlines the rules you want your portfolio manager to follow when it comes to investing your money. These rules can help you to avoid making emotionally driven decisions, in both favourable and difficult circumstances.

Along with your investor profile, the IPS is a useful tool we can use to help you invest. It contains basic information like your net value and some elements of your risk tolerance, although this may not be enough to create a strategy for your investment portfolio.

Your IPS is not a detailed financial plan. It is more like a blueprint for ensuring your plan stays on track for the long term. Think of it like a GPS, helping you to navigate any obstacles along the way so you can arrive safely at your destination.

Choosing an investment manager

Once we’ve established your asset allocation, we will help you choose the right investment managers—professionals whose investment philosophy and management style match your investor profile.

We will present you with a personalized proposal recommending one or more investment managers for every asset category. You will also receive detailed information on all the managers we recommend to facilitate your selection.

Professional portfolio management

Portfolio management is about ensuring all your financial investments (stocks, bonds, and more) bear fruit.

Whether you are knowledgeable about investing or new to the idea, portfolios are generally built around a balance of risk and return. The higher a portfolio’s return, the more risk there is to your assets. To limit risk, we will diversify your investment into different asset classes (shares, fixed-income securities), geographic regions, management types (active, passive), management styles (growth, value), and sectors.

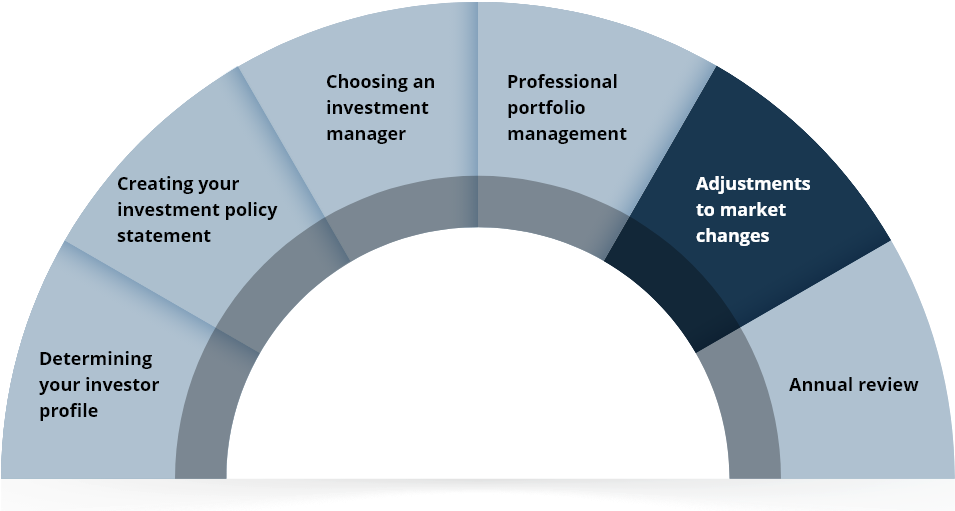

Adjustments to market changes

For an investment plan to be successful, it must be monitored on an ongoing and objective basis. Part of our work is managing risk in order to deliver the best possible return based on the risk level you’re comfortable with.

We do this by closely following evolving markets and staying in regular contact with asset allocation teams and selected portfolio managers.

We will not risk your investment by following temporary market fluctuations or jumping on the latest stock-market theories, and we will never chase after phenomenal returns if it means excessively risking your investments. We believe in security first.

Annual review

We will meet once per year to go over your investments and assess the results. This meeting will allow us to update your personal and professional situation, review the events that influenced your portfolio over the year, and evaluate your portfolio performance.

This is also when we can decide to keep the same investment strategy based on economic and financial forecasts, or if it’s time to change our investment plan.

We value your opinion

If you have questions or comments, or would like a second opinion on your portfolio and investments, please get in touch. It’s completely free with no commitment.